Fund Your Life’s Big

Plans – Faster.

ClearPath Debt Solutions helps you turn overwhelming credit cards and personal loans into one clear, manageable plan. Explore customized debt relief and loan options designed around your income, expenses, and real life—so you can move toward a debt-free future with confidence.

A Smarter Way to Handle Debt

Three Services

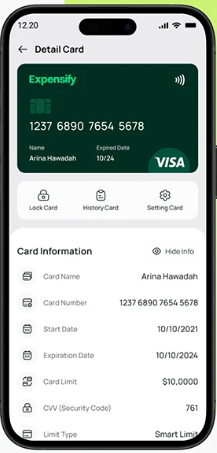

Get the money you need with clear terms, predictable payments, and options tailored to your situation. Our online process makes it easy to compare solutions, choose the right plan, and stay on top of your repayments.

Personal Loans

Use a fixed-rate personal loan to pay off high-interest credit cards or cover major expenses with one predictable monthly payment.

Debt Consolidation

Combine multiple unsecured debts into a single payment. Simplify bills, reduce stress, and get a clear payoff timeline.

Debt Negotiation

For accounts that are already behind or hard to manage, we can connect you with negotiation programs that seek to reduce the amount you owe.

What our Client Say About Us

“ClearPath made consolidating my credit card debt simple. I filled out the form on my lunch break and had my options explained clearly the same day.”

Christy H.

Marketing Manager

“I was overwhelmed by payments and collection calls. ClearPath walked me through my choices and helped me pick a plan I could actually afford. Now I can finally see a finish line.”

Peter L.

Homeowner“Running a small business means cash flow can be unpredictable. The working capital loan gave us room to grow without maxing out our cards.”

Chris D.

Café Owner“Having one personal loan instead of multiple store cards has been a game changer. I know exactly when I’ll be debt-free.”

Enrique C.

Graphic DesignerConnect With Trusted Tools

ClearPath Debt Solutions works with a curated network of reputable lending partners, debt-relief providers, and credit-counseling organizations. That means more chances to find a plan that fits your situation—without filling out multiple applications on different websites. One simple form, multiple tailored options.